Navigating the 2025 IRA Contribution Landscape: A Guide for Retirement Savings

Navigating the 2025 IRA Contribution Landscape: A Guide for Retirement Savings

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the 2025 IRA Contribution Landscape: A Guide for Retirement Savings. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the 2025 IRA Contribution Landscape: A Guide for Retirement Savings

The Individual Retirement Account (IRA) stands as a cornerstone of retirement planning, offering tax advantages and a framework for building long-term wealth. Understanding the contribution limits for these accounts is crucial for maximizing savings potential and ensuring a comfortable future. As we approach 2025, it is essential to familiarize oneself with the updated contribution limits and their implications for retirement planning.

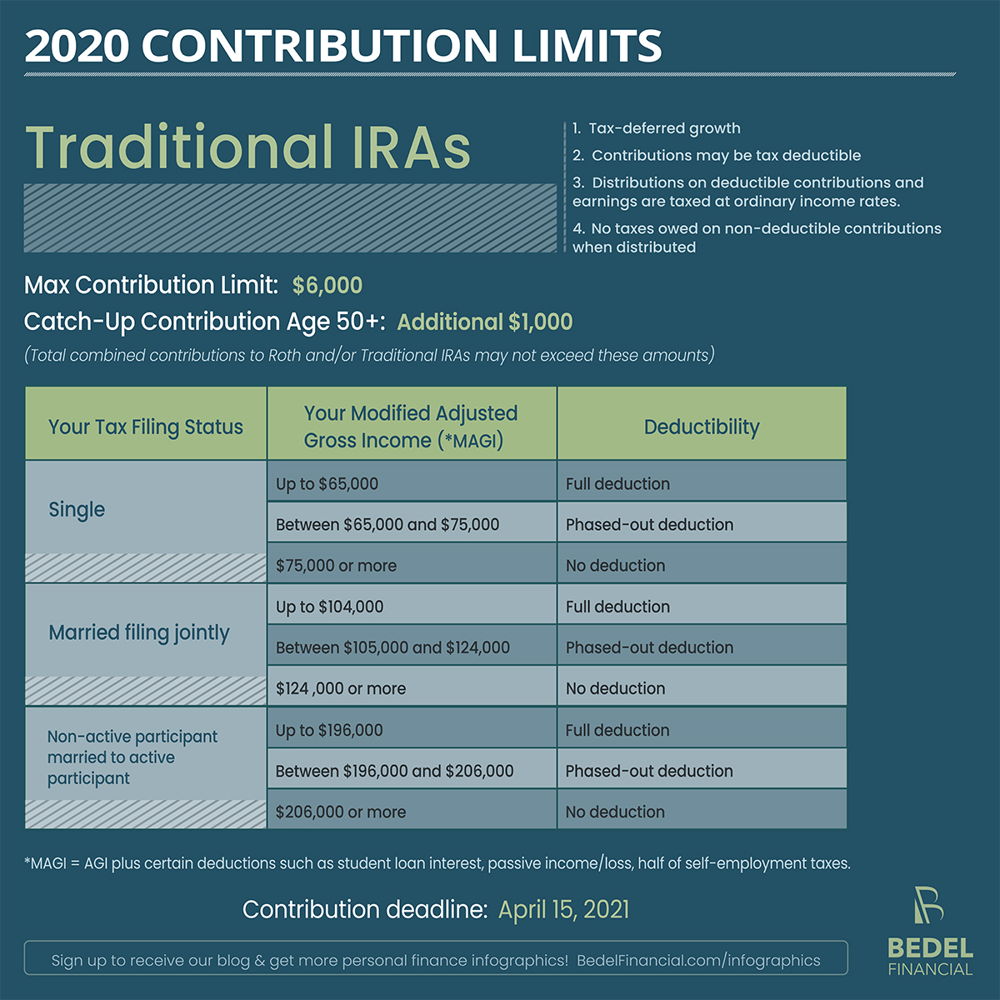

Traditional IRA Contribution Limits:

For 2025, the maximum contribution limit for Traditional IRAs remains at $6,500. Individuals aged 50 and older can contribute an additional $1,000 through catch-up contributions, bringing their total maximum contribution to $7,500.

Roth IRA Contribution Limits:

The 2025 contribution limit for Roth IRAs mirrors that of Traditional IRAs, also set at $6,500. The catch-up contribution for individuals aged 50 and older remains the same at $1,000, allowing for a total maximum contribution of $7,500.

Understanding the Significance of Contribution Limits:

These contribution limits serve as a guideline for annual contributions, ensuring that individuals do not exceed the maximum allowable amount for tax purposes. Adhering to these limits is crucial for avoiding potential penalties and maximizing the tax benefits associated with IRA contributions.

Factors Influencing Contribution Limits:

While the contribution limits are generally fixed, there are certain factors that can influence the amount an individual can contribute:

- Age: As mentioned previously, individuals aged 50 and older are eligible for catch-up contributions, increasing their maximum contribution limit.

- Income: For Roth IRAs, income limitations apply. If an individual’s Modified Adjusted Gross Income (MAGI) exceeds certain thresholds, they may not be eligible to contribute to a Roth IRA or may see their contributions phased out.

- Contribution History: If an individual has previously made contributions to a Traditional IRA, they may be subject to contribution limits based on their previous contribution history.

Benefits of Contributing to an IRA:

Contributing to an IRA offers a multitude of benefits for retirement planning:

- Tax Advantages: Traditional IRAs offer tax deductions on contributions, reducing current tax liability. Roth IRAs, on the other hand, provide tax-free withdrawals in retirement.

- Growth Potential: Contributions to IRAs grow tax-deferred, allowing for compounding returns and potentially substantial wealth accumulation over time.

- Flexibility: Individuals can choose between Traditional and Roth IRAs based on their individual circumstances and financial goals.

- Accessibility: IRAs are accessible to a wide range of individuals, regardless of their employment status or income level.

Tips for Maximizing IRA Contributions:

- Start Early: The earlier individuals begin contributing to an IRA, the greater the potential for growth and wealth accumulation.

- Contribute Regularly: Establishing a consistent contribution schedule ensures regular savings and maximizes the benefits of compounding.

- Consider Catch-Up Contributions: Individuals aged 50 and older should take advantage of catch-up contributions to accelerate their retirement savings.

- Review Your Contribution Strategy: Regularly assess your contribution strategy to ensure it aligns with your evolving financial goals and circumstances.

- Seek Professional Advice: Consulting a financial advisor can provide valuable guidance on optimizing IRA contributions and developing a comprehensive retirement plan.

Frequently Asked Questions (FAQs):

Q: What are the income limitations for Roth IRA contributions in 2025?

A: For 2025, the income limitations for Roth IRA contributions are as follows:

- Single filers: If your MAGI is $153,000 or higher, you cannot contribute to a Roth IRA.

- Married filing jointly: If your MAGI is $228,000 or higher, you cannot contribute to a Roth IRA.

Q: Can I contribute to both a Traditional and Roth IRA in 2025?

A: Yes, you can contribute to both a Traditional and Roth IRA in 2025, but your total contributions cannot exceed the annual contribution limit for each account.

Q: What happens if I exceed the contribution limit for my IRA in 2025?

A: If you exceed the contribution limit, you will be subject to a 6% excise tax on the excess contribution. Additionally, you may be required to withdraw the excess contribution, which could impact your retirement savings.

Q: Can I withdraw contributions from my IRA before retirement?

A: You can withdraw contributions from a Traditional IRA at any time without penalty. However, withdrawals from a Roth IRA before age 59 1/2 are generally subject to both taxes and a 10% penalty. There are exceptions to these rules, such as for first-time home purchases, qualified educational expenses, or medical expenses.

Conclusion:

Understanding the 2025 IRA contribution limits is a crucial step in building a secure and comfortable retirement. By maximizing contributions and taking advantage of the tax benefits offered by these accounts, individuals can set themselves up for a financially secure future. It is recommended to consult with a financial advisor to develop a personalized retirement savings plan that aligns with individual circumstances and goals.

Closure

Thus, we hope this article has provided valuable insights into Navigating the 2025 IRA Contribution Landscape: A Guide for Retirement Savings. We thank you for taking the time to read this article. See you in our next article!