Navigating Retirement Savings in 2025: A Guide to IRA and 401(k) Contribution Limits

Navigating Retirement Savings in 2025: A Guide to IRA and 401(k) Contribution Limits

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating Retirement Savings in 2025: A Guide to IRA and 401(k) Contribution Limits. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating Retirement Savings in 2025: A Guide to IRA and 401(k) Contribution Limits

As we approach 2025, individuals are increasingly focused on securing their financial future. Retirement savings plans, such as Individual Retirement Accounts (IRAs) and 401(k)s, play a crucial role in achieving this goal. Understanding the contribution limits for these plans is paramount for maximizing savings potential and achieving long-term financial security.

Understanding IRA and 401(k) Contribution Limits

Contribution limits for IRAs and 401(k)s are set annually by the Internal Revenue Service (IRS). These limits represent the maximum amount individuals can contribute to these plans in a given year without incurring tax penalties.

2025 IRA Contribution Limits

The contribution limit for traditional and Roth IRAs is expected to remain at $6,500 in 2025. Individuals aged 50 and older can contribute an additional $1,000 as a catch-up contribution, bringing their total contribution limit to $7,500.

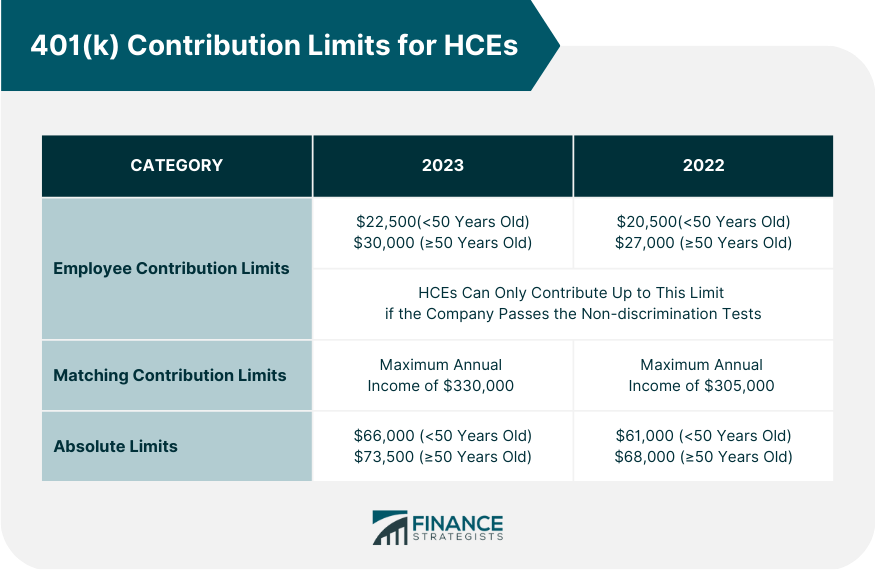

2025 401(k) Contribution Limits

The contribution limit for 401(k) plans is expected to rise to $22,500 in 2025. Individuals aged 50 and older can also make catch-up contributions, bringing their total contribution limit to $30,000.

The Importance of Contribution Limits

These contribution limits are crucial for several reasons:

- Maximizing Tax Advantages: IRAs and 401(k)s offer significant tax benefits. Traditional IRA contributions are tax-deductible, reducing taxable income and lowering current tax liability. Roth IRA contributions are made with after-tax dollars, but withdrawals in retirement are tax-free. 401(k) contributions are typically made on a pre-tax basis, reducing taxable income and lowering current tax liability.

- Compounding Growth: By contributing the maximum allowed, individuals can take full advantage of the power of compounding. Even small contributions can grow significantly over time, thanks to the magic of compounding.

- Building a Secure Retirement: Retirement savings plans are essential for ensuring financial security during retirement. By contributing the maximum allowed, individuals can build a substantial nest egg to cover their living expenses and achieve financial independence.

Factors Influencing Contribution Limits

While the IRS sets annual contribution limits, several factors can influence individual contributions:

- Age: Individuals aged 50 and older can contribute additional catch-up amounts to their IRAs and 401(k)s.

- Income: For Roth IRAs, income limitations apply. For 2025, individuals with modified adjusted gross income (MAGI) exceeding $153,000 (single filers) or $228,000 (married filing jointly) cannot contribute to a Roth IRA.

- Employer Matching: Some employers offer matching contributions to 401(k) plans. This means that for every dollar an employee contributes, the employer contributes a certain percentage. It is advantageous to contribute at least enough to receive the full employer match, as it is essentially free money.

FAQs about 2025 IRA and 401(k) Contribution Limits

Q: Can I contribute to both an IRA and a 401(k) in 2025?

A: Yes, you can contribute to both an IRA and a 401(k) in 2025. However, you must ensure that your total contributions to both plans do not exceed the individual contribution limits for each plan.

Q: What happens if I contribute more than the limit to my IRA or 401(k)?

A: If you contribute more than the limit, you may face penalties. The IRS will assess a 6% penalty on the excess contribution. You may also be required to pay taxes on the excess contribution.

Q: Can I withdraw money from my IRA or 401(k) before retirement?

A: While early withdrawals from IRAs and 401(k)s are generally discouraged, there are exceptions, such as for first-time home purchases, education expenses, or medical expenses. However, early withdrawals may be subject to taxes and penalties.

Q: What happens to my IRA or 401(k) when I retire?

A: When you retire, you can begin withdrawing money from your IRA or 401(k) without penalty. The specific rules and regulations for withdrawals vary depending on the type of account and your individual circumstances.

Tips for Maximizing IRA and 401(k) Contributions

- Contribute early and often: The sooner you start contributing, the more time your money has to grow through compounding.

- Take advantage of employer matching: If your employer offers a matching contribution, ensure you contribute at least enough to receive the full match.

- Increase contributions gradually: As your income increases, consider gradually increasing your contributions to your IRA or 401(k).

- Consult with a financial advisor: A financial advisor can help you develop a personalized retirement savings plan and ensure you are maximizing your contributions.

Conclusion

Understanding and maximizing IRA and 401(k) contribution limits is essential for achieving a secure and comfortable retirement. By taking advantage of the tax benefits and the power of compounding, individuals can build a substantial nest egg to support their financial needs in later years. Regularly reviewing contribution limits and making informed decisions about retirement savings can significantly impact future financial well-being.

Closure

Thus, we hope this article has provided valuable insights into Navigating Retirement Savings in 2025: A Guide to IRA and 401(k) Contribution Limits. We thank you for taking the time to read this article. See you in our next article!