Navigating Retirement Savings: A Comprehensive Guide to Roth IRA Contribution Limits for Individuals Over 60 in 2025

Navigating Retirement Savings: A Comprehensive Guide to Roth IRA Contribution Limits for Individuals Over 60 in 2025

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating Retirement Savings: A Comprehensive Guide to Roth IRA Contribution Limits for Individuals Over 60 in 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating Retirement Savings: A Comprehensive Guide to Roth IRA Contribution Limits for Individuals Over 60 in 2025

Retirement planning often involves a complex web of financial decisions. For individuals over 60, understanding the intricacies of retirement savings vehicles like the Roth IRA becomes particularly crucial. This article provides a comprehensive guide to the contribution limits for Roth IRAs in 2025, specifically focusing on the unique considerations for individuals over the age of 60.

Understanding the Roth IRA

A Roth IRA is a retirement savings account that allows individuals to contribute after-tax dollars. The key advantage of a Roth IRA lies in its tax-free withdrawals in retirement. This means that any earnings and withdrawals during retirement are not subject to federal income tax.

Contribution Limits for 2025

The annual contribution limit for Roth IRAs in 2025 remains unchanged from 2024, at $6,500. However, individuals over 50 years of age are eligible for an additional $1,000 catch-up contribution, bringing their total annual contribution limit to $7,500.

Important Considerations for Individuals Over 60

While the contribution limit remains consistent, individuals over 60 may face specific considerations when contributing to a Roth IRA:

-

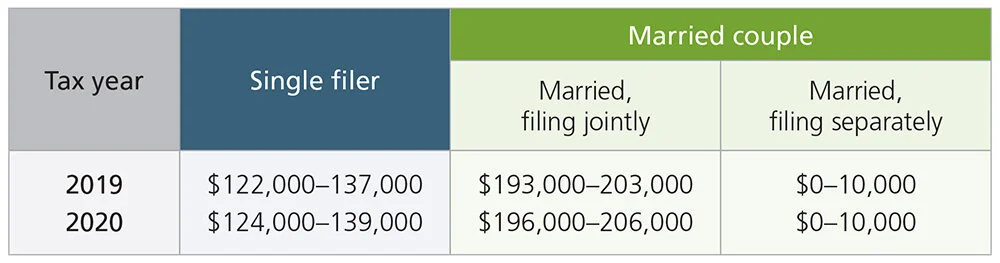

Modified Adjusted Gross Income (MAGI) Limits: The ability to contribute to a Roth IRA is subject to income limitations. For 2025, if your MAGI exceeds $153,000 as a single filer or $228,000 for married couples filing jointly, you cannot contribute to a Roth IRA. These limits apply regardless of age.

-

Retirement Income: If you are already receiving retirement income, contributing to a Roth IRA may impact your overall tax liability. It is essential to consult with a financial advisor to assess the potential impact on your tax situation.

-

Other Retirement Accounts: Individuals over 60 often have multiple retirement accounts, such as 401(k)s or traditional IRAs. It is crucial to consider the tax implications of contributions to these accounts and how they interact with the Roth IRA.

-

Tax Advantages: The tax-free withdrawals in retirement offered by a Roth IRA can be particularly advantageous for individuals over 60 who anticipate a higher tax bracket in retirement.

FAQs: Addressing Common Questions

Q: Can I contribute to a Roth IRA if I am already receiving Social Security benefits?

A: Yes, you can contribute to a Roth IRA even if you are receiving Social Security benefits. The two are not mutually exclusive.

Q: Can I contribute to a Roth IRA if I am still working?

A: Yes, you can contribute to a Roth IRA regardless of your employment status. You can even contribute to a Roth IRA if you are retired but still earning income from part-time work or other sources.

Q: What happens to my Roth IRA contributions if I pass away?

A: Your Roth IRA contributions will be passed on to your beneficiaries, who will inherit the account and its potential tax-free growth.

Tips for Maximizing Your Roth IRA Contributions

-

Start Early: The earlier you begin contributing to a Roth IRA, the more time your money has to grow tax-free.

-

Automate Contributions: Set up automatic transfers from your checking account to your Roth IRA to ensure consistent contributions.

-

Diversify Your Investments: Spread your investments across different asset classes, such as stocks, bonds, and real estate, to mitigate risk.

-

Review Your Investments Regularly: Periodically evaluate your investment portfolio and adjust it as needed to align with your financial goals and risk tolerance.

Conclusion

Understanding the contribution limits and specific considerations for Roth IRAs is crucial for individuals over 60 seeking to secure their financial future. While the contribution limit for 2025 remains unchanged, individuals should be mindful of income limitations and the impact of Roth IRA contributions on their overall tax situation. By carefully considering these factors and implementing sound investment strategies, individuals can maximize the benefits of a Roth IRA and enjoy a comfortable and financially secure retirement.

+1000px.jpg)

Closure

Thus, we hope this article has provided valuable insights into Navigating Retirement Savings: A Comprehensive Guide to Roth IRA Contribution Limits for Individuals Over 60 in 2025. We appreciate your attention to our article. See you in our next article!